- NIO reported an earnings per share (EPS) of -$0.45, missing the estimated EPS of -$0.22, indicating a widening net loss due to increased operating expenses and competition.

- The company’s actual revenue was $1.66 billion, significantly below the estimated $1.72 billion, highlighting financial pressures in the competitive EV market.

- Despite challenges, NIO’s vehicle deliveries increased by 40.1% year-over-year.

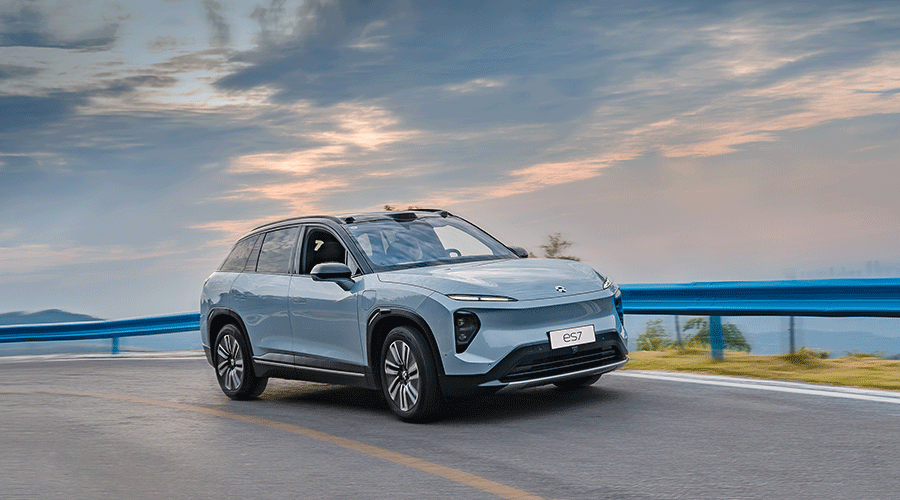

NIO Inc. (NYSE:NIO) is a prominent player in the electric vehicle (EV) market, known for its innovative approach to smart electric vehicles. The company operates in the highly competitive Chinese EV market, which is the largest in the world. NIO offers a range of vehicles under its premium brand, NIO, and its family-oriented brand, ONVO. Despite its strong market presence, NIO faces challenges in maintaining profitability.

On June 3, 2025, NIO reported an earnings per share (EPS) of -$0.45, falling short of the estimated EPS of -$0.22. This reflects a widening net loss, primarily due to increased operating expenses and intense competition. The company’s actual revenue for this period was approximately $1.66 billion, significantly below the estimated $1.72 billion, highlighting the financial pressures NIO faces.

NIO’s vehicle deliveries for the first quarter of 2025 totaled 42,094 units, marking a 40.1% increase compared to the first quarter of 2024. However, this was a 42.1% decrease from the fourth quarter of 2024, indicating fluctuating demand. Vehicle sales reached approximately RMB 9.9 billion (around $1.37 billion), an 18.6% increase from the same period in 2024, but a 43.1% decline from the previous quarter.

Financially, NIO’s negative price-to-earnings (P/E) ratio of approximately -2.29 indicates the company is not currently profitable. The price-to-sales ratio of about 0.81 suggests investors are paying $0.81 for every dollar of NIO’s sales. The enterprise value to sales ratio is approximately 1.03, reflecting the company’s valuation relative to its revenue.

NIO’s debt-to-equity ratio is notably high at approximately 5.67, indicating a significant amount of debt compared to its equity. The current ratio is just under 1 at approximately 0.99, suggesting potential challenges in covering short-term liabilities with short-term assets.