- FuelCell Energy, Inc. (NASDAQ:FCEL) reported a larger-than-expected quarterly loss but exceeded revenue expectations.

- The company has shown significant revenue growth, with a 67% increase from the previous year.

- FuelCell Energy is implementing a strategic restructuring plan to reduce operating expenses and focus on specific technologies for grid resilience and carbon recovery.

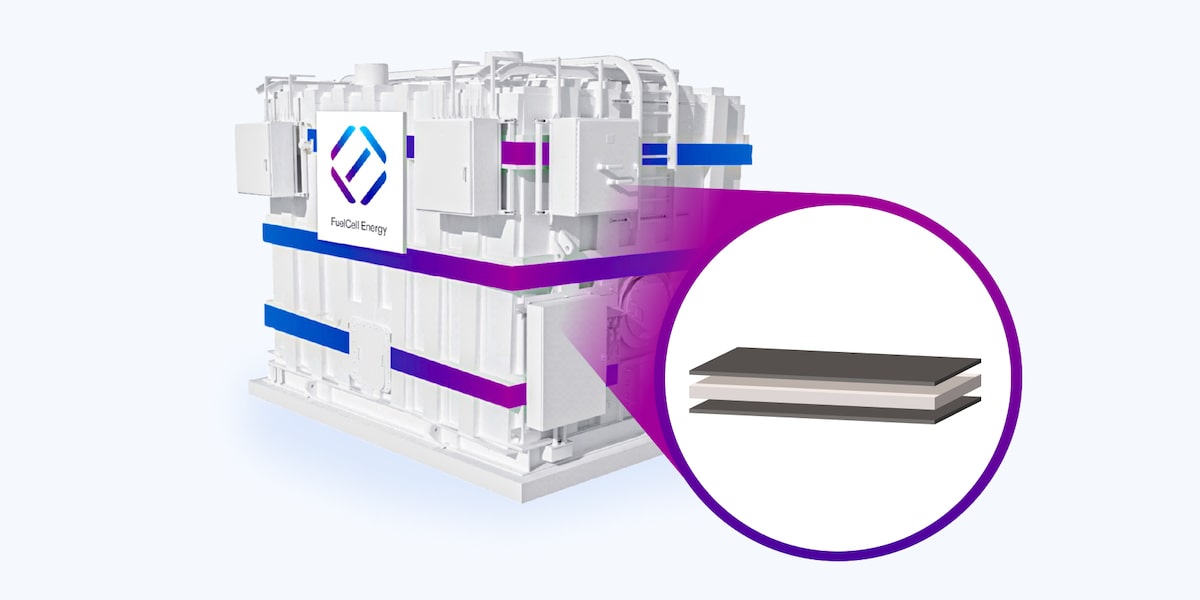

FuelCell Energy, Inc. (NASDAQ:FCEL) is a company in the alternative energy sector, focusing on clean energy solutions. It specializes in the development and commercialization of fuel cell power plants. Despite facing challenges in profitability, FCEL has shown resilience in revenue growth, as evidenced by its recent financial performance.

On June 6, 2025, FCEL reported an earnings per share (EPS) of -$1.79, which was below the estimated EPS of -$1.51. This quarterly loss was larger than the Zacks Consensus Estimate, yet it marked an improvement from the previous year’s loss of $2.10 per share. Despite the earnings miss, FCEL achieved a revenue of $37.4 million, surpassing the estimated $32.4 million.

The company’s revenue for the quarter ending in April 2025 increased by approximately 67% from the previous year’s $22.4 million. This growth is significant, as FCEL has exceeded consensus revenue estimates three times over the past four quarters. However, the company experienced a gross loss of $9.4 million, a 33% increase from the prior year’s $7.1 million.

FuelCell Energy’s strategic restructuring plan aims to reduce operating expenses by 30% annually compared to fiscal year 2024. The company is shifting its focus towards carbonate-based distributed generation and refocusing its solid oxide development efforts. This move is part of its strategy to enhance grid resilience and carbon recovery.

FCEL’s financial metrics reveal a price-to-sales ratio of approximately 1.44 and an enterprise value to sales ratio of about 1.81. The company’s debt-to-equity ratio is 0.22, indicating a relatively low level of debt. Despite a strong liquidity position with a current ratio of 6.34, the negative price-to-earnings ratio and earnings yield highlight ongoing profitability challenges.