Quantum computing may still be years away from widespread use, but analysts are already calling it the next great tech disruption—potentially bigger than fire, electricity, or the internet. According to Bank of America, this emerging field could reset global power structures and birth a $2 trillion industry by 2035.

From Science Fiction to Financial Forecasts

BofA’s latest note says it would take a human 50 quintillion years to match what a quantum computer could do in just one second. While full-scale, fault-tolerant quantum machines are still in development, timelines for commercial utility are now being pegged at 2030–2033.

They also see a major synergy with generative AI:

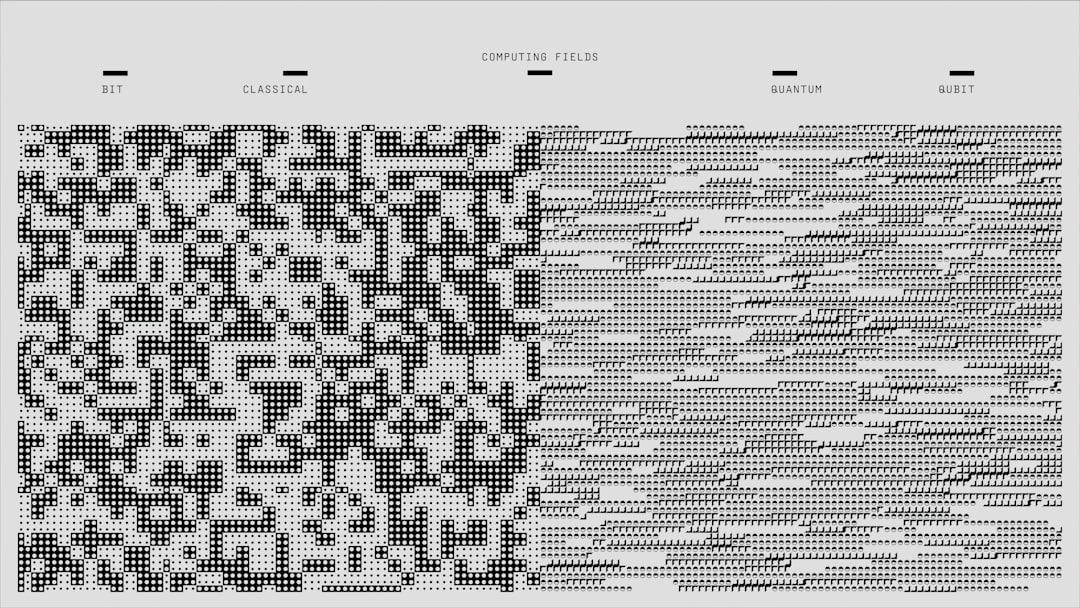

“A QC with just 10 qubits could perform 100x more operations than a classical computer,” BofA notes, calling the intersection a gateway to Artificial Super Intelligence.

Potential Use Cases:

-

Drug discovery

-

Military encryption

-

Materials science

-

Logistics

-

AI acceleration

The Winners of the Quantum Race Could Control the Next Era

In geopolitical terms, this isn’t just a tech race—it’s a power play. Nations or firms that gain early quantum advantage may dominate encryption, defense systems, and economic systems for decades.

For investors tracking the technology sector’s upgrades and downgrades, it’s becoming clear that quantum computing is influencing long-term ratings. You can monitor this shift using the Up/Down Grades by Company API, which reflects sentiment changes among analysts as quantum bets grow stronger.

What the Data Shows

Many top tech names are already seeing positive momentum in analyst outlooks, even without commercial quantum solutions in place. This reinforces the idea that Wall Street sees future optionality as a driver of valuation today.

Track analyst forecasts in real time using the Company Rating API, which includes trend ratings, sentiment evolution, and outlook adjustments.

Conclusion:

Quantum computing isn’t just theoretical anymore—it’s starting to shape market narratives, sector ratings, and long-term investment theses. If Wall Street is already re-rating the future, maybe it’s time we start doing the same.