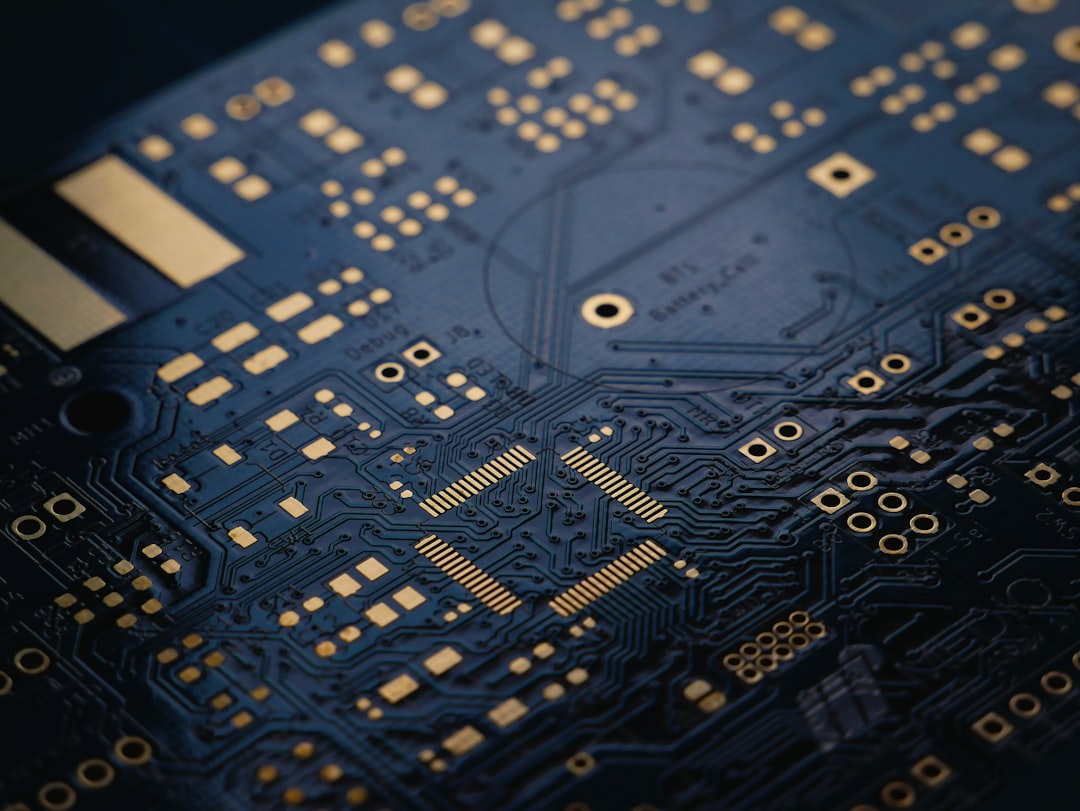

Taiwan Semiconductor Manufacturing Co. (TSMC) delivered strong second-quarter earnings, propelled by soaring demand for AI chips, but issued a cautious outlook for late 2025 due to potential trade tariffs.

AI Boom Drives Strong Q2 Performance

TSMC (NYSE:TSM) posted a 60.7% year-over-year rise in net profit, reaching T$398.27 billion ($13.52 billion) for Q2 2025. Revenue surged 38.6% to T$933.79 billion, beating market estimates.

-

EPS: T$15.36 ($2.47/ADR)

-

Gross margin: 58.6% (down from 64% YoY)

-

Key drivers: AI chip demand, particularly 3nm and 5nm wafer technology

-

Weak segments: Smartphone and IoT chips

CEO C.C. Wei emphasized that AI-related demand showed no signs of slowing, reaffirming TSMC’s dominance in advanced chip manufacturing. However, he flagged Q4 2025 as a potential soft spot due to uncertainty from global trade tariffs.

Currency and Expansion Pressure Margins

Despite the strong top-line numbers, the firm’s gross margins dipped, pressured by:

-

A strong Taiwan dollar

-

Increased overseas CapEx in the U.S. and Japan

CFO Wendell Huang projected gross margins between 55.5% and 57.5% for Q3, signaling manageable—but real—cost challenges.

TSMC in the Context of Broader Semiconductor Trends

To see how TSMC compares with its peers in valuation, margins, and revenue efficiency, you can track real-time Key Metrics (TTM) across the semiconductor sector:

👉 Key Metrics TTM – Financial Modeling Prep

This snapshot helps place TSMC’s AI tailwind and margin pressures in the broader competitive landscape—especially as rivals like Intel, Samsung, and NVIDIA chase the same advanced node market.

Bottom Line:

TSMC continues to ride the AI wave, and Q2 earnings prove it’s still the backbone of global chip innovation. But trade policies and currency fluctuations remain threats that could challenge its 2025 performance trajectory.

Let me know if you’d like a variation focused more on investment implications or sector-wide comparisons.