- FuelCell Energy reported an EPS of -$3.78, missing the estimated EPS but showing improvement from the previous year.

- The company generated revenue of approximately $46.7 million, slightly below estimates, with a price-to-sales ratio of about 0.91.

- Despite challenges, FuelCell Energy maintains a strong liquidity position with a current ratio of approximately 5.62 and a low debt-to-equity ratio of 0.22.

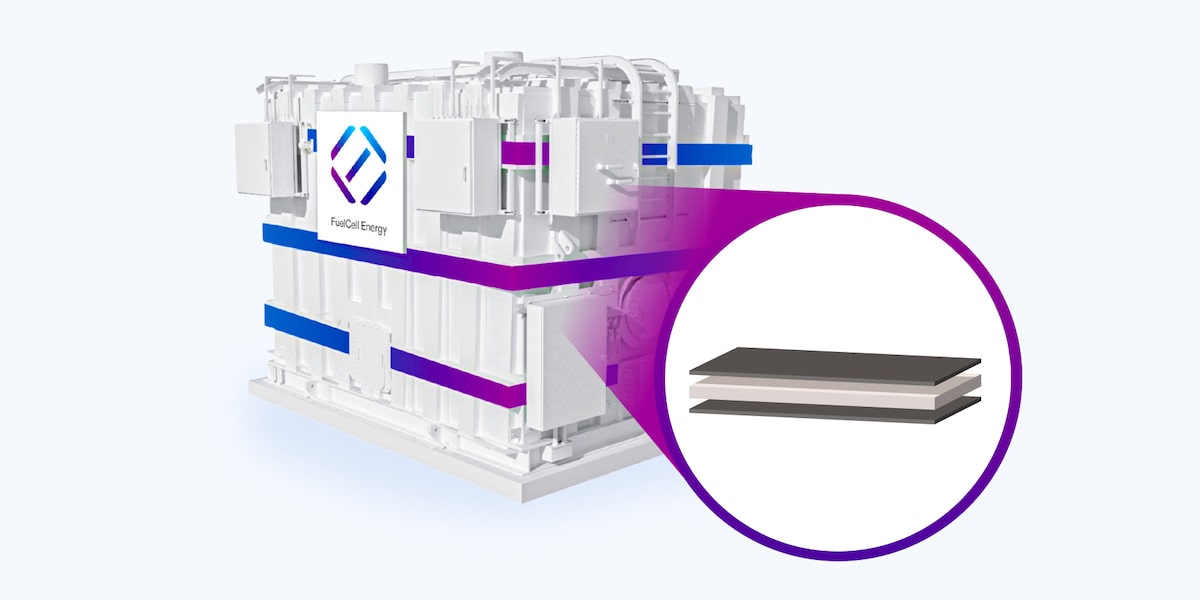

FuelCell Energy, Inc. (NASDAQ:FCEL) is a company that specializes in the design, manufacture, and operation of fuel cell power plants. These power plants are used for clean energy generation, providing an alternative to traditional fossil fuels. The company competes with other clean energy firms, striving to innovate and expand its market presence.

On September 9, 2025, FuelCell Energy reported an earnings per share (EPS) of -$3.78, which was significantly lower than the estimated EPS of -$1.59. FuelCell Energy generated a revenue of approximately $46.7 million, slightly below the estimated revenue of about $47.4 million. The company’s price-to-sales ratio stands at about 0.91, suggesting that the stock is valued at less than one times its sales. This indicates that the market may see potential in the company’s future sales growth.

The company’s financial metrics reveal a challenging situation. With a price-to-earnings (P/E) ratio of approximately -0.80, FuelCell Energy is currently not profitable. The enterprise value to sales ratio is approximately 1.18, reflecting the company’s valuation in relation to its revenue. The enterprise value to operating cash flow ratio is around -1.15, highlighting the negative cash flow situation.

Despite these challenges, FuelCell Energy maintains a strong liquidity position with a current ratio of approximately 5.62, indicating its ability to cover short-term liabilities. The debt-to-equity ratio is about 0.22, suggesting a relatively low level of debt compared to equity. This financial stability may provide a foundation for future growth and development.