Ant Group, the fintech giant and an affiliate of China’s Alibaba Group (NYSE: BABA), is reportedly planning to list its overseas arm, Ant International, on the Hong Kong Stock Exchange, according to Chinese media sources.

Key Details:

-

Potential Listing Location: Hong Kong

-

Ant International: A subsidiary of Ant Group, registered in Singapore

-

Regulatory Discussions: The company is reportedly in talks with regulators, although it remains unclear whether these discussions are taking place in China or other jurisdictions.

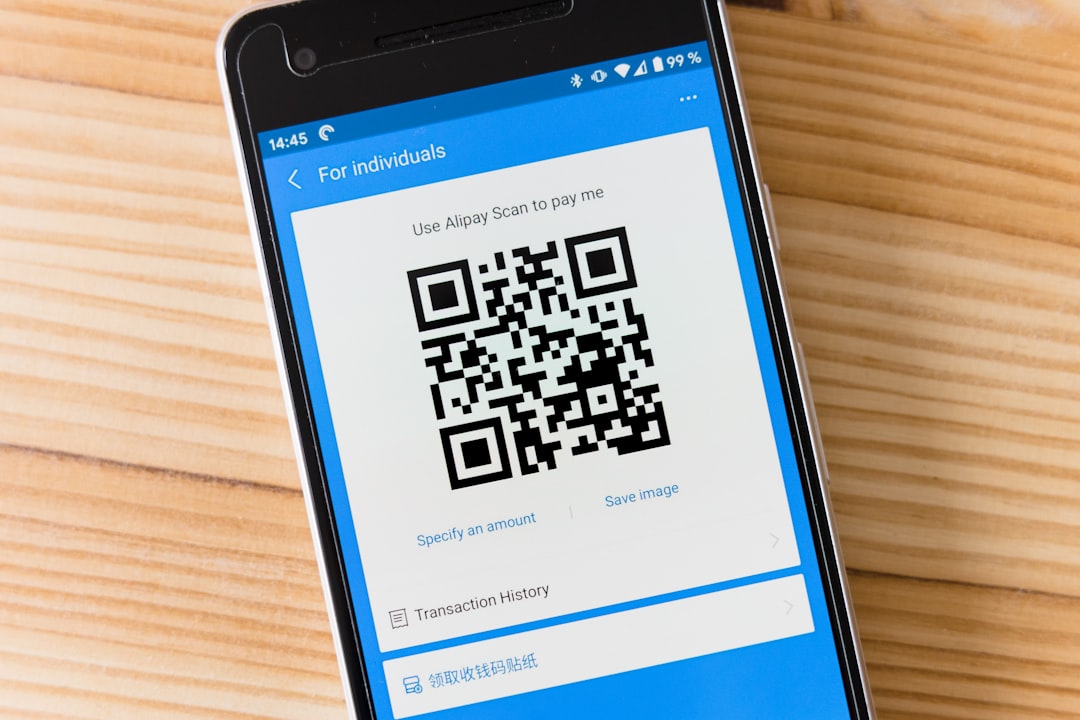

Ant Group, founded by billionaire Jack Ma, is a leader in China’s mobile payment sector, operating the widely-used Alipay platform. Alibaba holds a 33% stake in Ant Group.

Past IPO and Regulatory Challenges

Ant Group’s IPO ambitions were dealt a blow in 2020 when Chinese authorities suspended its $37 billion IPO, which was set to be listed on both the Shanghai and Hong Kong stock exchanges. This setback was triggered by increasing regulatory scrutiny and Ma’s public criticisms of China’s financial regulators, which were followed by a series of regulatory actions against the company.

Following these events, Ant underwent significant restructuring and faced nearly $1 billion in fines from Chinese regulators. Despite these hurdles, the company is still pursuing a financial holding company license, which could pave the way for the revival of its IPO aspirations.

This development has generated significant interest in the market, especially among investors eager to track Ant Group’s recovery and potential for growth in the fintech space. As the regulatory environment continues to evolve, further details about the listing and Ant’s future prospects will be closely watched.

For a deeper dive into financial trends related to the Chinese market or Ant Group’s upcoming strategies, we can explore data and analysis through APIs like China’s Economic Data or market insights using Stock and Equity Analysis.