- William Blair upgraded iRhythm Technologies, Inc. (NASDAQ:IRTC) to a “Buy” rating, indicating confidence in the company’s growth potential.

- The company’s Q4 2025 earnings call provided valuable insights into its financial performance and strategic direction.

- iRhythm’s current market capitalization stands at approximately $4.89 billion, with a trading volume of 1,445,876 shares, showcasing its strong market presence.

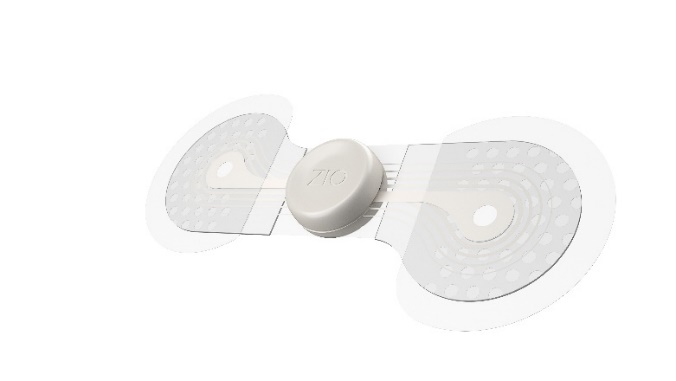

iRhythm Technologies, Inc. (NASDAQ:IRTC) is a healthcare technology company that specializes in providing innovative solutions for cardiac monitoring. The company is known for its Zio service, which offers a comprehensive platform for the detection of cardiac arrhythmias. iRhythm competes with other medical device companies in the cardiac monitoring space, striving to maintain a strong market position through technological advancements and strategic growth.

On February 20, 2026, William Blair upgraded iRhythm’s stock to a “Buy” rating, with the stock priced at $150.97 at the time. This upgrade suggests confidence in iRhythm’s potential, despite recent challenges related to subpoenas. The recommendation indicates that investors should consider purchasing the stock, as it may present a valuable opportunity for growth.

iRhythm recently held its Q4 2025 earnings call, providing insights into its financial performance and strategic direction. The call is a key event for investors, offering a detailed analysis of the company’s achievements and challenges. It helps stakeholders understand iRhythm’s future prospects and its position in the market.

Currently, iRhythm’s stock is priced at $151.85 on the NASDAQ, experiencing a 4.42% decrease today, dropping by $7.03. The stock’s trading range today was between $145.49 and $164.69. Over the past year, the stock has fluctuated significantly, with a high of $212 and a low of $92.52, reflecting the company’s dynamic market environment.

iRhythm’s market capitalization is approximately $4.89 billion, with a trading volume of 1,445,876 shares. This indicates a strong market presence and investor interest. The company’s ability to navigate challenges and capitalize on opportunities will be crucial for its continued success in the competitive healthcare technology sector.